Is there VAT on Google Ads?

by Roy Dovaston

It's not always clear if VAT is included or how to account for it when using Google Ads. However, when UK businesses invest in Google Ads, understanding the VAT implications is crucial. Google, headquartered in Ireland, does not charge VAT on these services. Instead, UK VAT-registered businesses must apply the "reverse charge" mechanism.

What is the Reverse Charge Mechanism?

The reverse charge shifts the responsibility of accounting for VAT from the supplier to the buyer. For UK businesses purchasing services from overseas suppliers like Google, this means:

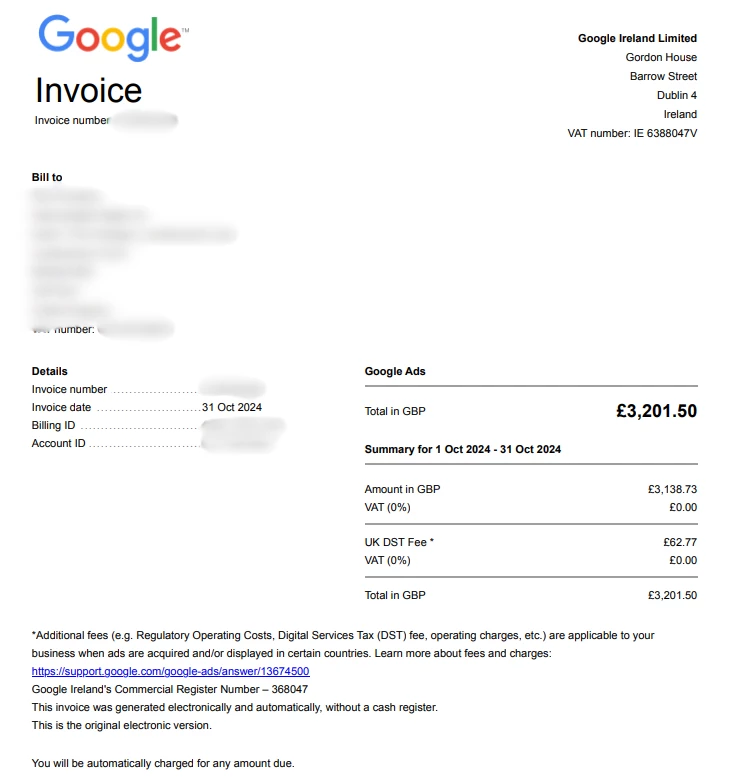

No VAT on Invoice: Google's invoices for ad services will not include VAT.

Self-Accounting for VAT: The UK business must calculate and record the VAT as both output tax (payable) and input tax (recoverable) on their VAT return.

Steps to Comply:

Calculate VAT: Determine the VAT amount by applying the current UK VAT rate (20%) to the net cost of your Google Ads expenditure.

Record on VAT Return: Enter this VAT amount as both output tax and input tax in your VAT return.

Benefits of the Reverse Charge:

Cash Flow Neutrality: Since the VAT is both payable and recoverable, there's no immediate cash outflow.

Simplified Record-Keeping: All VAT entries are managed internally, eliminating the need to reclaim VAT from Google.

Important Considerations:

VAT Registration: Only VAT-registered UK businesses should apply the reverse charge. Non-VAT registered businesses will have VAT included on their Google Ads invoices.

Accuracy: Ensure precise calculations and record-keeping to avoid potential penalties from HMRC.

In summary, while Google doesn't charge VAT on its ad services, UK VAT-registered businesses must self-account for this VAT using the reverse charge mechanism. This approach simplifies transactions and maintains cash flow neutrality. For personalised advice, consulting with a qualified accountant is recommended.